April 13, 2011

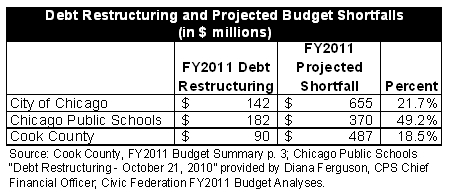

The three largest municipal governments analyzed by the Civic Federation are the Chicago Public Schools (CPS), the City of Chicago and Cook County. All three began their FY2011 budget processes projecting large budget shortfalls: CPS projected a gap of $370 million, the City of Chicago projected a gap of $655 million and Cook County projected a gap of $487 million.[1] These budget shortfalls were primarily the result of existing structural imbalances that were exacerbated by declines in economically sensitive revenues. Ultimately, all three turned to debt restructuring as a key method to close their shortfalls.

The governments’ debt restructuring plans involve refunding existing bonds to realize interest savings and /or extending payments to provide budgetary relief. Below are some key facts on the governments’ debt restructuring activity:

- Chicago Public Schools: CPS completed a debt restructuring late last year that provided approximately $182 million for FY2011 and will provide $45 million in FY2012. CPS expects that it will not be able to significantly restructure its debt again in the near future.[2] The restructuring allowed CPS to avoid depleting its fund balance as originally proposed in its FY2011 budget.

- Cook County: The County recently posted a request for proposals for a debt finance team to assist with debt restructuring that is expected to generate $85 to $90 million in FY2011 and in the next two fiscal years. The County’s current bond structure included additional payments that would have become due in FY2011. The restructuring will increase debt service payments from 2014 through 2031,[3] which will amount to a net present cost of $60 million.[4]

- City of Chicago: The City has scheduled a significant amount of refunding to be completed in 2011[5] and allocated $142 million in savings for the FY2011 budget. The City asserted during the budget process that no debt would be extended beyond the useful life of the assets that were purchased and a net present value savings would be achieved. The City also used debt restructuring in its FY2010 budget.

The chart below outlines the percentage of the budget shortfall that was closed with debt restructuring for each government. Nearly half of the CPS deficit was closed with debt restructuring while Cook County and the City of Chicago both used debt restructuring to close approximately a fifth of their shortfalls. Debt restructuring was the largest single budget gap closing strategy for the City of Chicago and Chicago Public Schools.

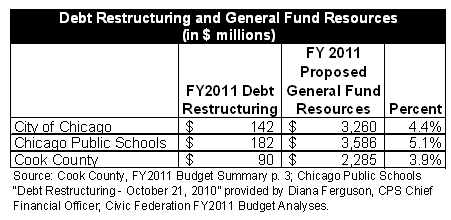

The next chart shows debt restructuring as a percentage of all general fund resources. From this perspective there is less variation between the governments with all three utilizing debt restructuring to increase available general fund resources by between 4% and 5% of each governments’ FY2011 budgeted resources.

When developing its position on various municipal budgets, the Civic Federation considers bond restructuring based on the specifics of the transaction, the use of funds and the overall budget of the government. The Civic Federation is generally supportive of bond restructuring if the transaction achieves a net present value savings and does not extend debt service beyond the life of the asset. The Civic Federation is concerned when the proceeds from restructuring are used as a non-recurring revenue source (/civic-federation/blog/funding-cliffs-municipal-budgets) to fund operating expenses. The use of bond restructuring by the largest Chicago area municipalities to fund operating expenses is a sign of fiscal stress and structural challenges.